Investment in Corporations

Seven Seas offers solutions to corporate challenges, including CRE strategy and issues of inheritance / business succession, to ensure optimal use of assets. We work with companies to help revitalize their business by creating multifaceted, multilateral business plans with specialists in business revitalization, law, accounting, and tax counseling as an independent investment management firm.

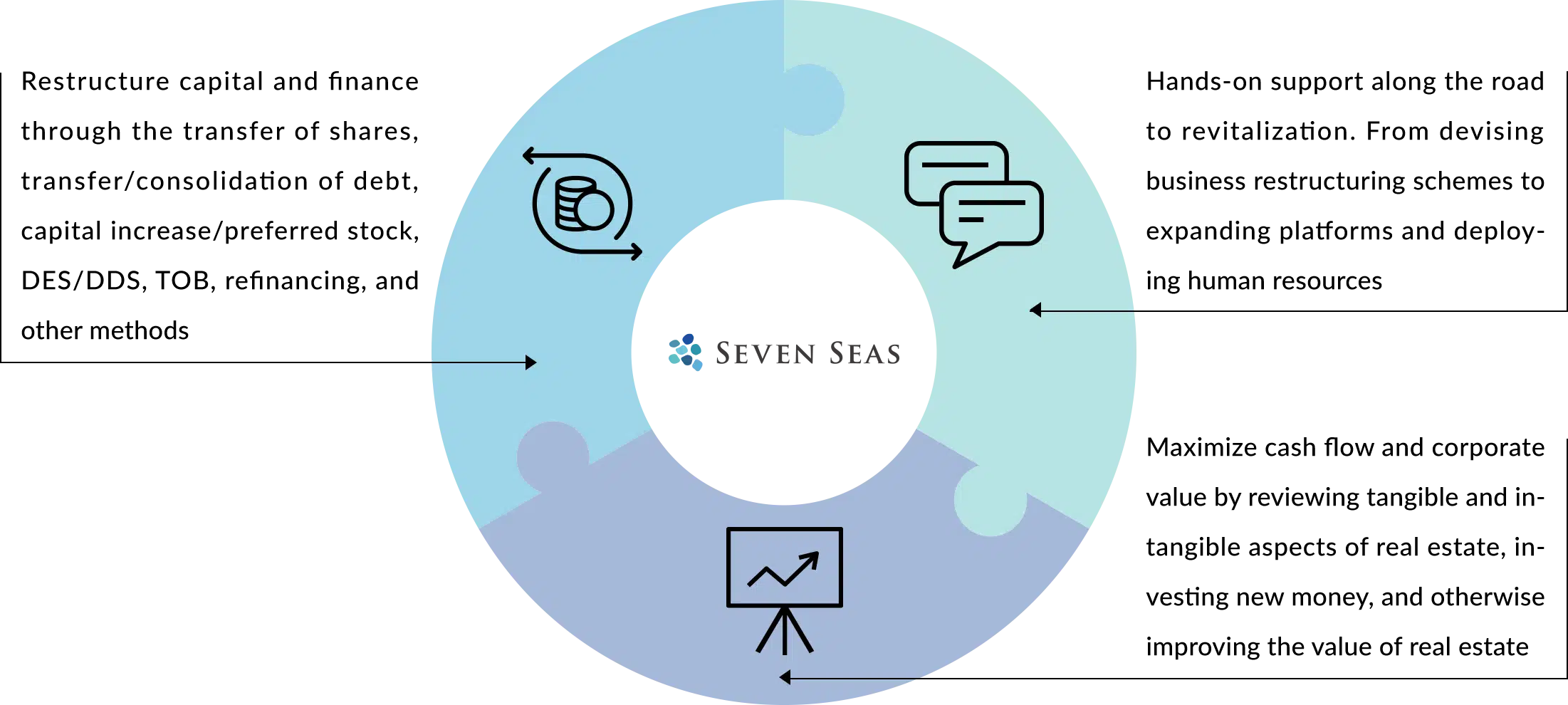

Investment Methods

Our Approach

Seven Seas provides support and guidance on company management, capital, finance, and human resources.

-

Full support to facilitate discussions with shareholders, creditors, and other stakeholders

-

Proposes optimal structures that would allow for stable, sustainable management, including company splits, business transfers, company restructuring, and more

-

Using capital increases, TOB, DDS, DES, refinancing, and more to rebuild a capital/financial base

-

Provides investment necessary for revitalization when there are restrictions on transactions with financial institutions

-

Support for rebuilding relationships with financial institutions and getting on the track to growth

-

Provides optimal solutions for issues of inheritance and lack of successors

-

Works together to create a feasible future plan and provides support toward achieving it

-

Provides internal/external management resources and personnel backup as needed

-

Uses Seven Seas' extensive network to provide support for platform expansion

Seven Seas aims to maximize corporate value by providing capital and knowledge on effectively enhancing the value of real estate holdings.

-

Consults on tangible aspects such as use conversion, renovation, seismic resistance, legal compliance, and long-term maintenance costs

-

Consults on intangible aspects such as tenant negotiations, tenant mix, operators, and management fees

-

Develops, implements, and provides funding for measures to improve tenant satisfaction and enhance asset value through rebranding

-

Maximizes operation stability and cash flow by providing new funding for underutilized, unfinished, and aging properties

-

Improves liquidity through adjustments in rights, such as strata title ownership, joint ownership, and land leasehold

-

Enhances property value through collaboration and support from local public organizations and businesses